BOFIT Viikkokatsaus / BOFIT Weekly Review 2021/47

In July, the European Commission released a proposal on measures designed to bolster the more ambitious emission-reduction targets approved by the EU this year. One measure in the proposal is the carbon border adjustment mechanism (CBAM), whereby importers would be charged for the carbon emissions embodied or embedded in goods imports produced outside the EU. The main purpose of the CBAM is to prevent carbon leakage, i.e. the shifting of carbon-intense production from countries with stringent emission restrictions to countries with lax policies or enforcement. Carbon leakage is currently dealt with through the allocation of free carbon allowances to European producers, but these allowances would be gradually phased out during the implementation of the CBAM. Under the European Commission’s proposal, the CBAM would cover certain cement, fertiliser, steel and aluminium products, as well as electricity imports. CBAM charges would be based on the price of carbon allowances in the EU’s emissions trading scheme (ETS). It would be based on the realized carbon emissions directly generated in the production of the imported goods. Where realized emissions data are unavailable, certain reference values would be used. The current plan is to launch the CBAM at the beginning of 2026.

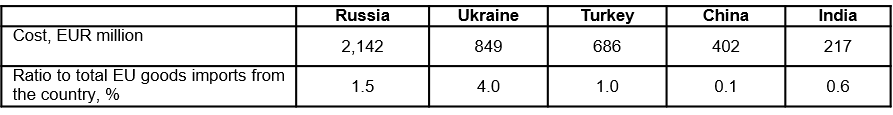

A just-released BOFIT Policy Brief provides cost assessments of CBAM impacts on Russia and four other emerging economies. Although such calculations are subject to several uncertainties, the exercise shows Russia could incur costs of roughly 2 billion euros a year with a carbon price of 60 euros a ton (the average price level in the ETS in recent months). This would correspond to 1.5 % of the value of total EU goods imports from Russia in 2019. The projected costs are for 2035 when free allowances would cease to be provided to European producers. Costs in the initial phase of the CBAM rollout would be significantly lower than in latter phases as EU producers would still receive free allowances under the ETS.

Estimates of annual costs to five emerging economies under the EU’s carbon border adjustment mechanism in 2035

Note: The estimate is based on 2019 import volumes and a price of 60 euros per ton in the ETS carbon emission allowance.

It reflects the situation in 2035, when free ETS allowances will no longer be provided to EU producers.

Source: BOFIT Policy Brief 10/2021.