BOFIT Viikkokatsaus / BOFIT Weekly Review 2021/29

The Organization of Petroleum Exporting Countries and Russia (OPEC+) finally reached agreement last week on raising oil production quotas. The higher production ceilings reflect an across-the-board increase in crude oil prices this year. The price of Russian Urals-grade crude, for example, was up by about 50 % year-to-date in the first week of July.

Under the current OPEC+ agreement, production is assumed to return to pre-pandemic levels by the end of 2022. Production ceilings will rise every month starting in August 2021. After the United States (production 11.3 million barrels a day), Russia last year was the world’s second-largest crude oil producer (9.9 million barrels a day). Under the latest OPEC+ agreement, Russia’s oil output can rise from the current 10.5 million barrels a day to 11.5 million barrels a day by the end of May 2022.

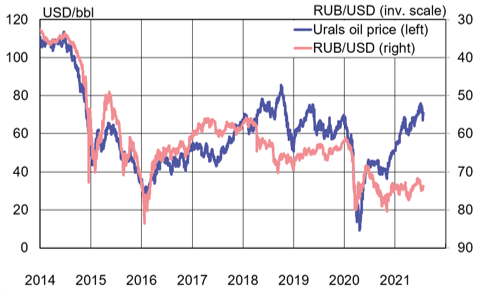

Prices of shares and commodities plunged at the start of this week on concerns about the spread of the delta variant of the coronavirus and its possible impact on global economic activity. The price of Urals crude fell below $70 a barrel for the first time since the start of June. The ruble’s exchange rate showed no change, however.

Although the price of Urals crude dropped sharply last week, the ruble’s exchange rate barely wavered

Sources: Reuters and BOFIT.