BOFIT Weekly Review 31/2021

Russian economy has recovered from last year’s recession, but pace of recovery varies considerably across branches

The Russian economy has largely recovered from the recession in spring 2020, and most recoveries have gradually continued in recent months. In the first quarter of this year, GDP was already slightly higher than it was two years previous (i.e. in the first quarter of 2019). The Ministry of Economy Development reports that the increase in the second quarter was about 1.5 % from the second quarter of 2019.

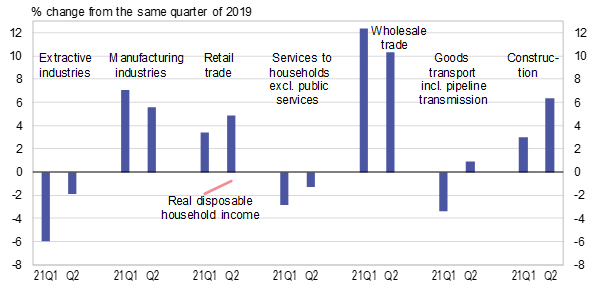

The strength of the recovery varies among core sectors of the economy. For example, the output of extractive industries has recovered notably. In the second quarter of this year, it was down by just 2 % from two years previous. Under the OPEC+ agreement, crude oil output has gradually clawed its way back towards pre-pandemic levels and was down by 6 % from two years previous in the second quarter. Natural gas production was several percent higher than two years previous. Support services for oil & gas production, which constitute a slightly larger branch than natural gas production alone, experienced growth of over 20 % from two years previous.

Manufacturing production has recovered quite well. Second quarter output was about 5.5 % higher than two years previous (7 % in the first quarter). Growth has been broad-based. In the six largest manufacturing branches, the increase from two years previous was 7−8 % in the food industry, more than 13 % in the chemical industry, over 30 % in the metal product industry, as well as 7 % in machinery and equipment branches. Of all manufacturing branches, only metal refining was down in the second quarter from two years previous. On the other hand, manufacturing growth has levelled of this year. In the past couple of months, seasonally adjusted output has declined. The seasonally adjusted manufacturing purchasing manager’s index (PMI) fell significantly in July on the heels of a few positive months. According to the survey, the drop reflects reduced production and fewer new orders. Rosstat’s company survey also found that near-term prospects for manufacturing output and orders were continuously quite tepid in July.

The volume of retail sales in the second quarter was up by 5 % from two years earlier, and no longer more than 5 % lower than in the second quarter of 2014, when retail sales hit their peak in the last decade. Seasonally adjusted sales have increased rather slowly in recent months, though. Services offered to households (excluding those provided by the public sector) recovered in the second quarter to a level only slightly below two years previous. Rosstat’s quarterly survey of consumer expectations of their own household for the next four quarters found modest expectations. The Bank of Russia monthly survey, which in recent months has found rather good expectations, dropped rather sharply in July.

The recovery in consumption has not been driven so much this year by real disposable household income, which was still down by nearly 1 % from two years previous in the second quarter. Consumption this year has been bolstered by very low net household saving compared to the recession in spring 2020 as well as 2019. Net saving includes net household borrowing from banks, which has increased in recent months as regards consumer credit. This is the mirror opposite of spring 2020, when net borrowing for consumption declined as is quite typical during economic downturns. In the second quarter, the number of people employed returned nearly to the same level as two years previous.

Wholesale has recovered strongly, up 10 % from two years previous in the second quarter. Construction activity is also up considerably from two years ago. The volume of goods transported (including pipeline transmission of crude oil, petroleum products and natural gas) was up slightly from two years previous.

Output levels in different branches of the Russian economy are quite varied when compared to levels in 2019

Sources: Rosstat and BOFIT.