BOFIT Weekly Review 25/2021

Significant differences in pace of development in various sectors of the Russian economy

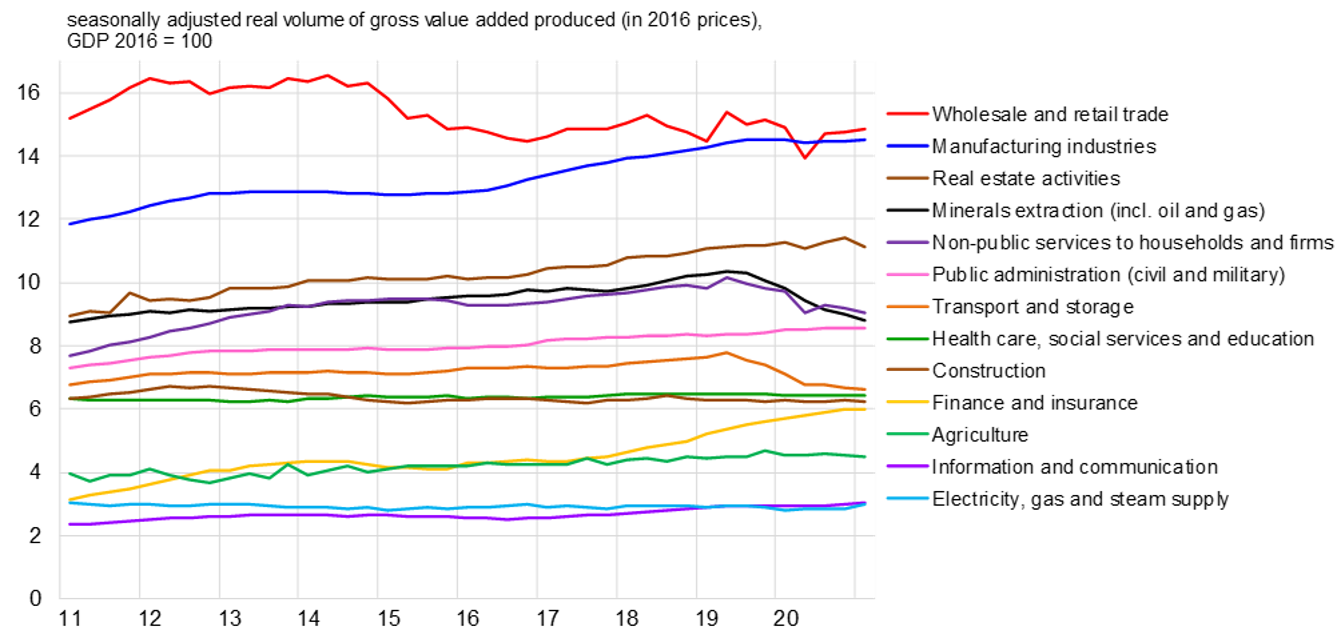

Manufacturing activity, when measured in the real volume of gross value added produced (GVA), has been quite flat since summer 2019 and showed hardly any downward impact from the Covid Recession last year. Over the longer term, manufacturing has experienced rather steady growth, with the GVA volume increasing by about 20 % since 2011. In contrast, the GVA volume in the minerals extraction industries (including oil & gas) in the first quarter of this year was on par with the 2011 level, and about 14 % lower than its 2019 peak. The reduced volume largely reflects the OPEC+ agreement on production ceilings requiring cuts in Russia’s crude oil production.

The wholesale & retail branch has recovered to a notable degree from spring 2020. So much so that the GVA volume already in the second half of 2020 was only some 2 % less than in 2018 and 2019. In the first quarter of this year, the figure was slightly above zero. However, the recovery in wholesale and retail from the deep contraction of 2015−2016 has yet to occur. The branch’s GVA volume is still 10 % lower that its 2012−2014 peak and 5 % below its 2011 level.

The transport and warehousing branch contracted over the past two years, a reflection of the weak performance of trade and oil production cuts that have reduced the volume of oil transmitted by pipeline. The branch’s GVA volume is still 10 % less than its 2018−2019 levels and about 3 % below its 2011 level, which to some extent may reflect logistical improvements in transport and distribution. While construction activity did not decline during last year’s Covid Recession, the sector has not experienced growth for years. The real estate sector with its various sizeable activities, in turn, has grown steadily. It also weathered 2020 rather well.

Various services to firms and households, largely provided by private firms, experienced a considerable GVA volume drop as a whole during the past two years. These services have seen no sign of recovery, and their collective GVA volume remains at the 2014 level. Separately, information and communications branches, in contrast, have grown almost steadily at a fairly good pace, with only a mild dip during the Covid Recession. The financial sector has been Russia’s fastest-growing category, experiencing especially high growth in each of the past three years. Part of this growth can reflect efficiency gains from embracing digital technology. In addition, the growth in bank lending last year was accelerated by stimulus efforts on the part of the government and the central bank.

Public administration (civil and military administration), which has enjoyed growth for most of the past decade, got a further kick last year from government budget spending increases, even if most public administration jobs are not on the front lines in the fight against covid. The healthcare field has long experienced growth, though it is not up by more than 15 % from 2011. Measured in GVA volume, growth in the healthcare field came to a halt last year. This may reflect disruptions in the provision of other healthcare services due to the struggle with covid. Developments in the education branch have been notably uneven, with an overall decline for nearly three years. Thus, the branch’s activity measured in GVA volume is slightly lower than in 2011.

The GDPs produced by different sectors of the Russian economy have moved variably over the past decade

Sources: Rosstat and BOFIT.