BOFIT Weekly Review 17/2021

Recovery of Russian economy continues

Russia’s Ministry for Economic Development estimates that GDP grew in March by 0.5 % y-o-y, while GDP was still down by over 2 % y-o-y in January-February. The economy ministry also estimated that the on-year change for all of the first quarter was -1.3 %.

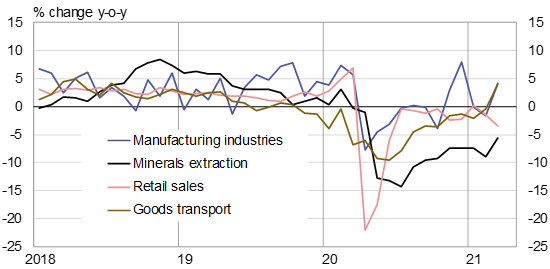

Industrial output in the first quarter was 1.3 % smaller than four quarters earlier, but the situation is quite different in industrial main categories. Mineral extraction output has recovered gradually. In February-March, seasonally adjusted growth of mineral extraction was nearly 1 % m-o-m. However, in March the output was still down by 5−6 % y-o-y and in the first quarter the on-year drop was over 7 %. This basically reflects the ongoing OPEC+ agreement on oil production ceilings that should gradually come to an end by April 2022. The agreement has reduced Russia’s oil production by about 10 % y-o-y. In contrast, production of natural gas and coal bounced back from their last year´s falls in the first quarter (up by 8 % y-o-y and 10 %, respectively). A significant category consists of oil & gas-related services, which have remained several percent lower on-year since spring 2020.

Seasonally adjusted output of manufacturing industries continued to rise in February and March at about 1 % m-o-m. March manufacturing output was up by over 4 % y-o-y, and by nearly 1 % y-o-y for all of the first quarter. Not counting oil refining, manufacturing output has increased for five consecutive years. Production also grew slightly amidst last year’s recession, and in the first quarter production was up by 2 % y-o-y. Much of the rise came from a revival of growth in the machinery, equipment & vehicles categories, as well as ongoing growth in pharmaceutical and chemical production. Chemical industry remains an important branch of growth to Russia. The sector has grown by nearly 50 % since the first quarter of 2014. Pharmaceutical production continues to spearhead industrial growth, with output tripling over the past seven years.

The recovery in household consumption in the homeland has been sluggish. The volume of seasonally adjusted retail sales remained quite unchanged in February and March. Retail sales in the first quarter were down by 1.5 % y-o-y. This was due to a roughly 3.5 % y-o-y drop in March. The figure partly reflects the unusual retail spike of March 2020, when people hoarded goods they expected to need during the impending covid lockdown. The situation has improved in service branches (excluding public sector services), but they were still down by over 4 % y-o-y in the first quarter.

Goods transport increased significantly in March, raising the freight volumes for the first quarter to 0.5 % y-o-y. Large transport volumes are produced by rail freight and pipeline transmission of oil & gas, which both recovered close to their 2020 first quarter levels.

Core sectors of the economy have experienced quite different recovery paths from last year’s shocks

Sources: Rosstat and BOFIT.