BOFIT Weekly Review 25/2020

Ukraine gets new 18-month IMF loan

The IMF’s executive board signed off on a new Stand-By Arrangement (SBA) for Ukraine last week. The programme runs for 18 months, allowing Ukraine to tap into a $5.5 billion credit line. While the first disbursement to Ukraine of $2.1 billion was released immediately to help the country stabilise its economy during the COVID-19 pandemic, release of four other tranches require that Ukraine continues to adhere to its SBA conditions.

Ukraine is also seeking a $1 billion loan from the World Bank. Other international financial institutions traditionally require a valid IMF program before lending to a country. The IMF SBA should also facilitate new EU lending to Ukraine.

As is standard with IMF loan programs, Ukraine had to implement a number of policy measures before the loan was granted. Measures requested by the IMF included changes in the tax code and revision of customs regulations. Ukraine’s banking laws also had to be amended to make sure that the restructuring of the Ukrainian banking sector remains on track.

Ukraine was still enjoying relatively favourable economic trends last year, with GDP increasing by 3.2 % and the general government deficit falling to just 2 % of GDP. The IMF expects Ukraine’s GDP to decline by 8.2 % this year and forecasts a slow recovery in coming years: just 1.1 % GDP growth in 2021 and 3.0 % in 2022.

As of end-2019, Ukraine's general government debt was $78 billion, or about 50 % of GDP. The county’s liabilities to international financial institutions (including the IMF) amounted to about $10.3 billion.

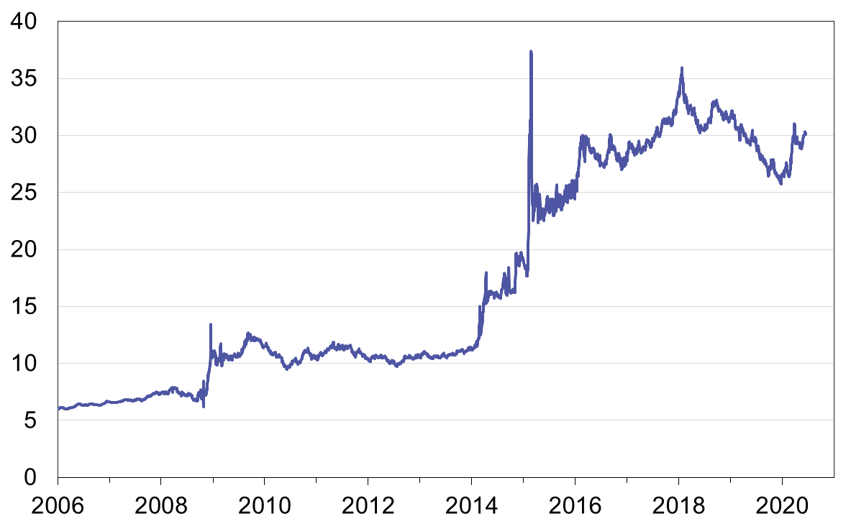

The Ukrainian hryvnia has depreciated against the euro this year, UAH/EUR rate

Sources: National Bank of Ukraine and BOFIT.