BOFIT Weekly Review 13/2018

Latest BOFIT Russia forecast sees gradual economic recovery continuing

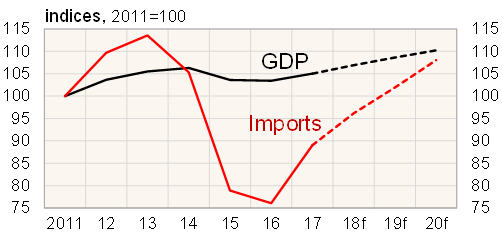

The economy recovered last year, with GDP rising 1.5 %. Relative to the swings in global oil prices, the recession was mild and recovery slow as the ruble's floating exchange rate significantly dampened the swings.

BOFIT Forecast for Russia expects GDP to rise by nearly 2 % this year and slightly exceed its 2014 peak. In 2019–2020, annual GDP growth should average about 1.5 % as long as the oil price remains near its current level and as proper reforms that would support growth are not in sight.

Household consumption continues its moderate recovery. General increases in government sector wages and pensions still this year are rather meagre in real terms, but should then increase. Corporate sector wages should rise reasonably compared to productivity gains. Consumption is supported by relatively low inflation.

The revival in fixed investment will continue as the worn-out capital stock requires replacement and its high utilisation calls for investment in new capacity. High growth is not expected as the major investment phases of large projects are becoming past and appetite for new investment is limited, especially by the defective business environment.

Government expenditures are set to rise slowly as the new budget rule frames spending. It limits the deficit and defines computational oil & gas tax revenues. Other revenues should no longer increase rapidly with the projected GDP growth.

Growth in Russia's export volume should slow as the ruble is relatively strong and energy exports only rise slowly. The recovery in Russia's imports will slow this year from last year's big rebound and a bit further thereafter on fading growth of export earnings. Even so, imports will grow rather briskly, but only climb close to the 2012 level in 2020.

Risks to the forecast include possible deviations from the expected oil price, impairment of the good global economic growth outlook and developments in international incidents. The growth of Russia's export volume could exceed anticipations, although production capital could pose a tighter-than-expected constraint on exports and also more broadly on domestic production. A tax reform envisaged in Russia could slow consumption growth and support domestic production.

Russian GDP and import volumes, 2012−2020

Sources: Rosstat and BOFIT.