BOFIT Weekly Review 30/2023

Economic growth in China slowed in the second quarter of this year

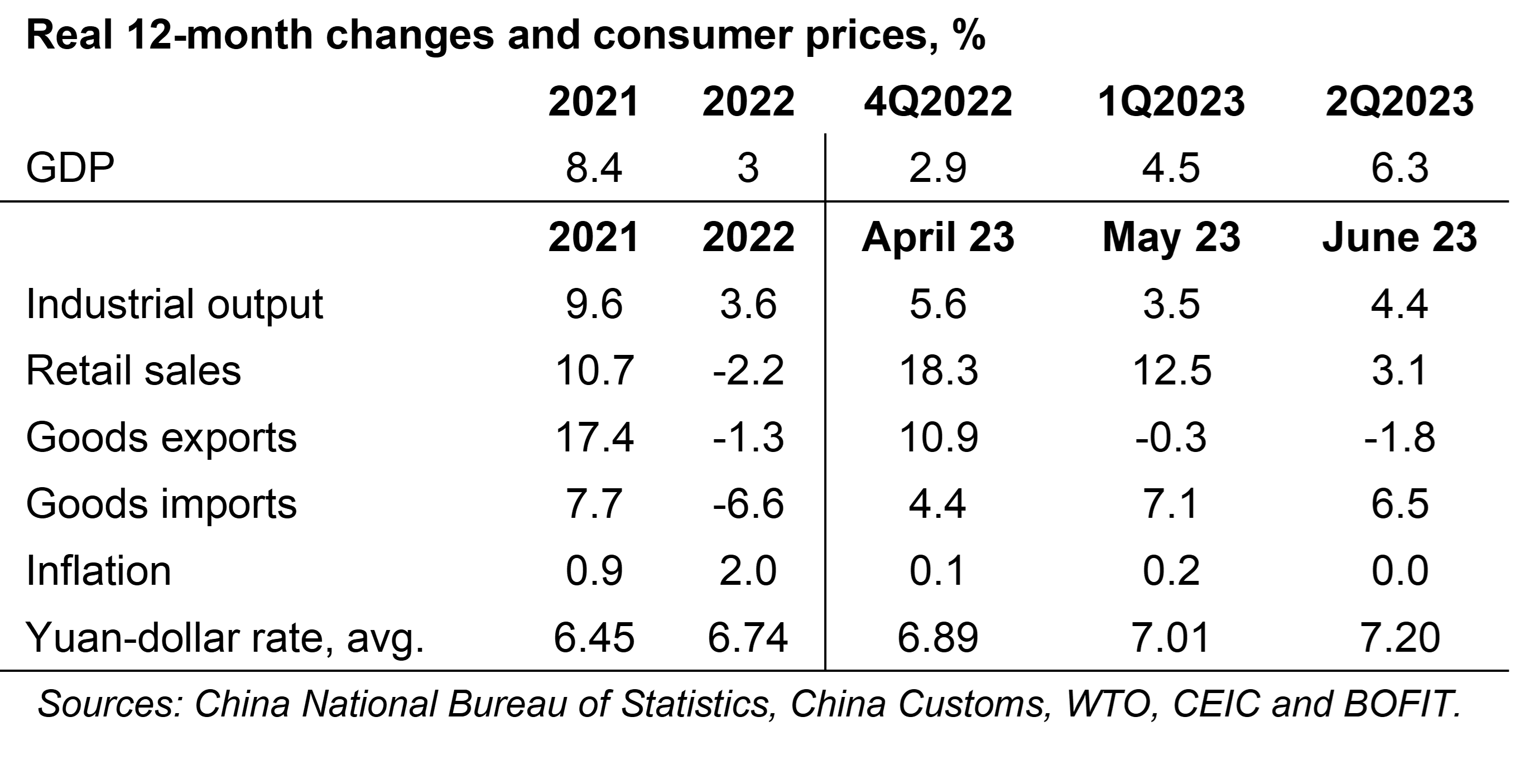

China’s National Bureau of Statistic (NBS) reports GDP grew 6.3 % year-on-year in the second quarter, up from 4.5 % in the first quarter. However, the growth acceleration from the first quarter was largely due to the low basis reference of 2Q22. On-quarter growth in the second quarter was just 0.8 %, well below the 2.2 % growth posted in the first quarter. The slowing of economic growth reflects weak private demand, the ongoing struggles in China’s real estate sector and subdued export demand.

The growth spurt after the ending of covid restrictions seems to have been short-lived. BOFIT’s alternative calculations of Chinese GDP growth suggest that the pace of growth in the second quarter was a couple percentage points lower than official figures. According the China’s official figures, nearly two-thirds of 2Q GDP growth came from the service sector, and around third from manufacturing and construction. NBS figures show that the value-added in the service sector rose by 7.4 % y-o-y. Value-added was up by 4.5 % in manufacturing and 8 % in the construction sector.

On average, in the first half of this year, real disposable income growth kept pace with GDP growth (up 5.8 %), but was clearly lower in urban areas (4.7 %). Real growth in retail sales slowed to just 3.1 % in June, while consumer price inflation fell to zero. The fall in inflation was contributed especially by housing-related services and products (down 0.5 % y-o-y), as well as transport and communications services, the category that includes vehicle fuel prices (down 6.5 %). Food prices rose by 2 %, while education, cultural activities and recreational services were up by 1.5 %. June producer prices fell by 5.4 % y-o-y. The biggest drop in producer prices was seen in the mining & quarrying sector (down 16 %) and raw material industries (down 10 %). Producers prices for consumer durable goods, for example, were down by just 1.5 %.

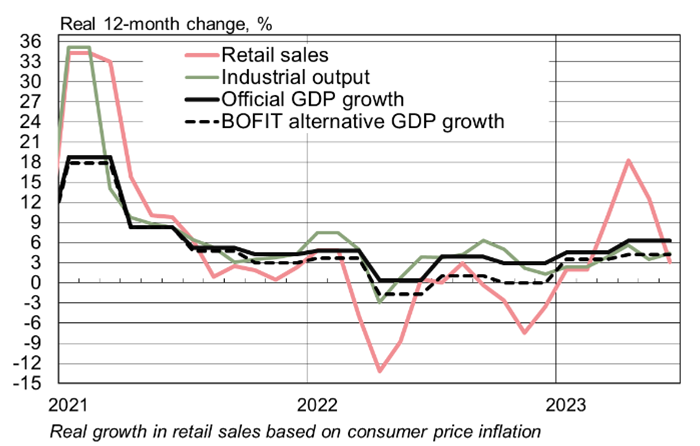

The much-anticipated growth spurt in China’s post-lockdown economy seems to have fizzled out

Sources: NBS, CEIC, Macrobond and BOFIT.

Industrial output was up by nearly 5 % y-o-y in June and about 4 % higher for the first half of this year. Particularly high growth was posted in manufacturing of solar panels (up 55 % in 1H23 from a year earlier), electrical vehicle (up 35 %) and industrial computers and systems (up 34 %).

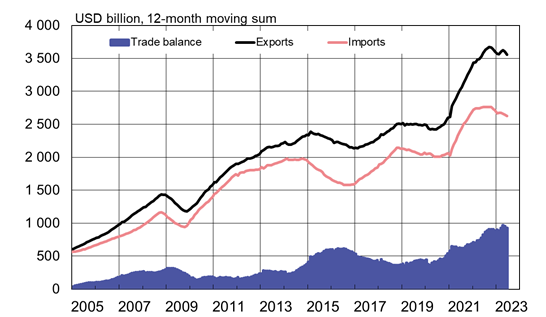

Non-growth in China’s foreign trade is now well into its second year following the strong performance in 2021. In June the value of exports was down by 14 % in dollar terms. For all of the second quarter, the value of exports was down by more than 5 %. The value of imports in June fell by 8 % in dollar terms, while the decline for the second quarter was 7 % overall. Part of the drop in dollar terms is a reflection of yuan depreciation against the dollar and falling prices. According the figures from China Customs, export volume were up by about 3 % y-o-y in the second quarter, while import volumes grew by 6 %. Volumes of both exports and imports have contracted by 1 % over the past twelve months.

Chinese foreign trade growth has been stalled for over a year

Sources: China Customs, CEIC and BOFIT.

China’s real estate sector continues to struggle. After a few months of stability, apartment sales, measured both in terms of yuan valuation and square metres of floorspace, started to decline again. The number of new building starts continues to plunge. The volume of new production measured by floorspace in June reached a level not seen since 2009. In the first half of this year, the real estate sector’s investments were off by 14 % from a year earlier. Even so, there has been progress in clearing some of the backlog of uncompleted construction projects. Measured in floorspace, the volume of completed buildings increased from a year earlier for the sixth straight months in a row. In June, 15 % more buildings were completed than in the same period a year earlier, and the number of unfinished projects fell by 7 %. The NBS reports that housing price trends remain tepid.

The loan stock of banks grew by about 12 % y-o-y in June. Most growth came from corporate lending as the total stock of lending to households rose by just 3 % y-o-y. On-year growth in China’s broad measure, total social financing, which was up by over 9 % in the second quarter, has remained well above the pace of GDP growth and the debt levels have continued to climb. The bank loan stock relative to GDP rose to 186 % in the second quarter. China’s total debt-to-GDP ratio, which combines private and public-sector debt, hit 295 % in June, 13 percentage points higher than in June 2022. The fiscal condition of local governments has become a source of particular concern for the country’s leaders.

POLITBURO SIGNALS NEED FOR INCREASED STIMULUS SPENDING

The politburo of the Communist Party of China (CPC) met on Monday (July 24). The July meeting typically deals with economic policy issues for the rest of the year. The statement released from this year’s meeting acknowledged the country’s difficult economic situation and announced the need of actions to get economic growth back on track. Among other things, the politburo’s statement emphasised the need to bolster domestic demand, improve investor confidence and reduce risks associated with the indebtedness of local governments. It is likely that concrete stimulus measures will be announced in coming months.

With respect to the real estate sector, perhaps the most important change went unsaid. For the first time in years, Xi Jinping’s “houses are for living, not speculation” mantra was removed. This could point towards more demand-side stimulus, for example, an easing of restrictions on apartment buyers. The government has already abandoned most regulations initially intended to decrease China’s major developers debt (BOFIT Weekly 06/2023).