BOFIT Weekly Review 4/2019

China’s ratio of bank credit to GDP continues to rise

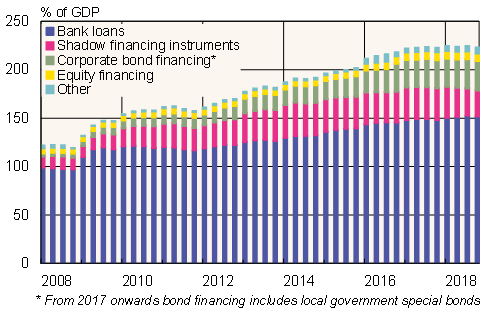

China’s bank lending stock rose by 13 % y-o-y in December. However, monetary easing last year failed to significantly boost bank lending and economic growth as growth in the bank credit stock has averaged 12–13 % p.a. since 2016. Still, growth was considerably higher than nominal GDP growth (10 %). As of end-2018, the bank credit stock corresponded to 152 % of GDP (137 trillion yuan, 20 trillion dollars).

The stock of bank lending to households still grew by 20 % last year, despite deceleration due to a smaller rise in apartment prices. Household loans represented 39 % of all new bank loans issued last year and 28 % of the total bank credit stock. Excluding loans to households, the stock of bank lending rose by 11 % last year.

Central bank figures suggest that the stock of shadow-banking sector credit instruments (entrusted loans, trust loans and banker's acceptances) shrank by 11 % last year to 27 % of GDP (24 trillion yuan, 3.5 trillion dollars).

The ratio of corporate bonds to GDP was 30 %. That share does not include bonds issued by the government or banking sector, which are by far the largest bond issuers in China. Local governments have increasingly turned to issuance of so-called special-purpose bonds to finance infrastructure projects. The central government has raised special-purpose bond quotas for local governments to allow them to reduce their off-balance-sheet financing through local government financial vehicles. Last year, the PBoC added local government special-purpose bonds to be included in its aggregate financing statistics arguing that special-purpose bonds substitute for other financing formats such as bank loans and corporate bonds. The amount of special-purpose bonds on issue has more than doubled since early 2017. They now represent over a quarter of bonds on issue.

Non-bank corporate and household financing sources (stock)

Sources: PBoC, CEIC and BOFIT.