BOFIT Weekly Review 51/2021

Central Bank of Russia continued to tighten monetary policy

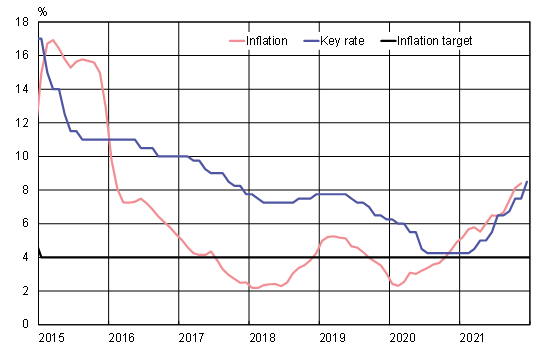

Last Friday (Dec. 17), the Central Bank of Russia (CBR) hiked its key rate by a full percentage point to deal with accelerating inflation. The new rate is 8.5 %. The CBR began to tighten its monetary policy last March and has since raised the key rate seven times. The key rate was last time this high in September 2017. In its forward guidance, the CBR did not rule out the possibility of further hike at its next meetings.

November inflation hit 8.4 % p.a., well above the CBR’s 4 % inflation target. The acceleration in inflation is broad based and due to multiple factors, some of which are transitory. Inflation risks are still elevated, but the CBR expects inflation to slow to 4‒4.5 % by the end of 2022.

The CBR also updated its forecast for the Russian economy, noting that it now expects the GDP growth of 4.5 % this year. In its October forecast, the CBR was expecting 2021 growth in the range of 4‒4.5 %.

Central Bank of Russia continued to tighten monetary policy to counter rising inflation

Sources: Macrobond, CBR, Rosstat and BOFIT.