BOFIT Weekly Review 24/2023

People’s Bank of China eases monetary stance as economic recovery remains more sluggish than expected

In mid-July China’s central bank cut all main policy rates by 10 basis points. The rate cut came at the same time as the May economic figures were released by NBS, which showed that the 12-month change for industrial output and retail sales slowed in May. Industrial output increased by 3.5 % y-o-y. Retail sales were up by 12.7 % in nominal terms. The PBoC last lowered its policy rates in August 2022.

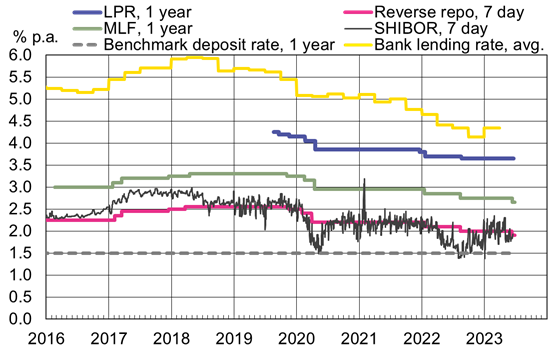

The PBoC lowered rates under the programmes it uses to inject liquidity into the financial system. The tenth-of-a-percent cut was quite modest. On Thursday (Jun.15), the 1-year rate for the medium-term lending facility (MLF) for banks was lowered from 2.75 % to 2.65 %. On Tuesday (Jun. 13), the 7-day reverse repo rate, used in daily open market operations, was cut to 1.9 % and the rates for the standing lending facility (SLF) were lowered. The overnight SLF rate declined to 2.75 %. The loan prime rate (LPR), the reference rate for bank lending set by the PBoC based on the recommendation of 18 panel banks, is expected to be lowered next as it is based on the MLF rate. LPR rates are announced on the 20th day of each month. The May LPR rate for a 1-year loan was 3.65 % and the 5-year loan rate 4.3 %. Banks add their own margins to the rates in setting the actual loan cost.

The PBoC lowered its main policy rates by 10 basis points in mid-June

Sources: CEIC, PBoC, National Interbank Funding Center and BOFIT.

News sources report the PBoC gave guidance to commercial banks in May and June in advance of the rate cuts that they should lower their deposit rates by 5 to 30 basis points. To give the guidance teeth, the central bank resurrected the “interest rate self-disciplinary mechanism” it oversees. The mechanism was originally introduced in 2013 (few years before regulated bank rate setting was abolished), and in practice, it still defines the upper bound for loan rates based on the benchmark deposit rate the PBoC still continues to publish. Commercial banks cannot breach this ceiling, but they can offer lower deposit rates. Banks worries about eroding profitability were apparently the main reason for the PBoC’s decision to issued guidance on lowering the deposit rates. The interest margin of banks are a record low even before the policy rate cuts, as central bank has instructed banks to lower their corporate lending rates to support the businesses. Media reports note that mid-sized banks in May lowered their 1-year deposit rate to 1.85 % and 3-year deposit rate to 2.95 %.

The rate cuts are hoped to stimulate demand for bank loans, which weakened in May. Lower deposit rates are also hoped to revive consumption. Growth of the bank lending stock slowed from 12.2 % in April to 11.8 % in May. The rise in aggregate financing to the real economy (AFRE) slowed to 9.8 % y-o-y (10.3 % in April). Notably, corporate bank lending growth slowed down. Very low inflation could permit even more accommodative monetary policies. The on-year rise in consumer prices in May was just 0.2 % (0.1 % in April). Producer prices, which largely track energy prices, declined in May by 4.6 % y-o-y.

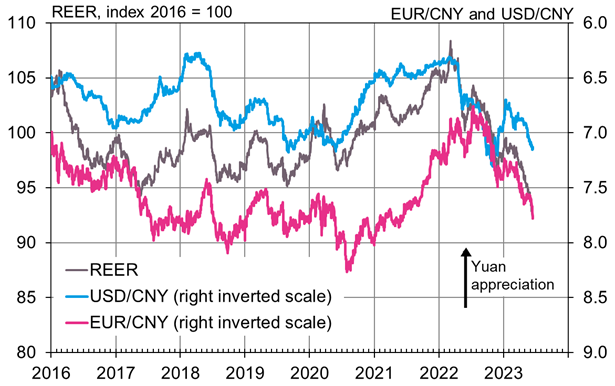

Increased depreciation pressure on the yuan and the risk of increased capital flight are, however, restricting more aggressive monetary policy easing. Since mid-April, the yuan has lost about 4 % of its value against the dollar, and its real effective (trade-weighted) exchange rate (REER) has dropped by 5 %. With the US and most advanced economies tightening their monetary stances, the interest rate spread with China has widened. On Wednesday (June 14), the yield on China’s 10-year government bond was 2.61 %, compared to 3.83 % for the US 10-year bond. As a result, foreign investors have been pulling their money out of the mainland China markets. The Institute of International Finance finds that foreign investors, who returned to mainland China’s stock markets with the economic reopening in the first quarter, cut their investments in April-May. Foreign investors have also been reducing their exposure to China’s debt markets since March. In the first five months of this year, the shareholdings of foreign investors in equity markets have risen by 34 billion dollars, while their holdings in the bond market have fallen by 59 billion dollars.

The yuan has lost ground this year against both the dollar and euro

Sources: Macrobond, J.P. Morgan and BOFIT.