BOFIT Weekly Review 9/2023

Russia’s economic contraction last year mitigated by government spending

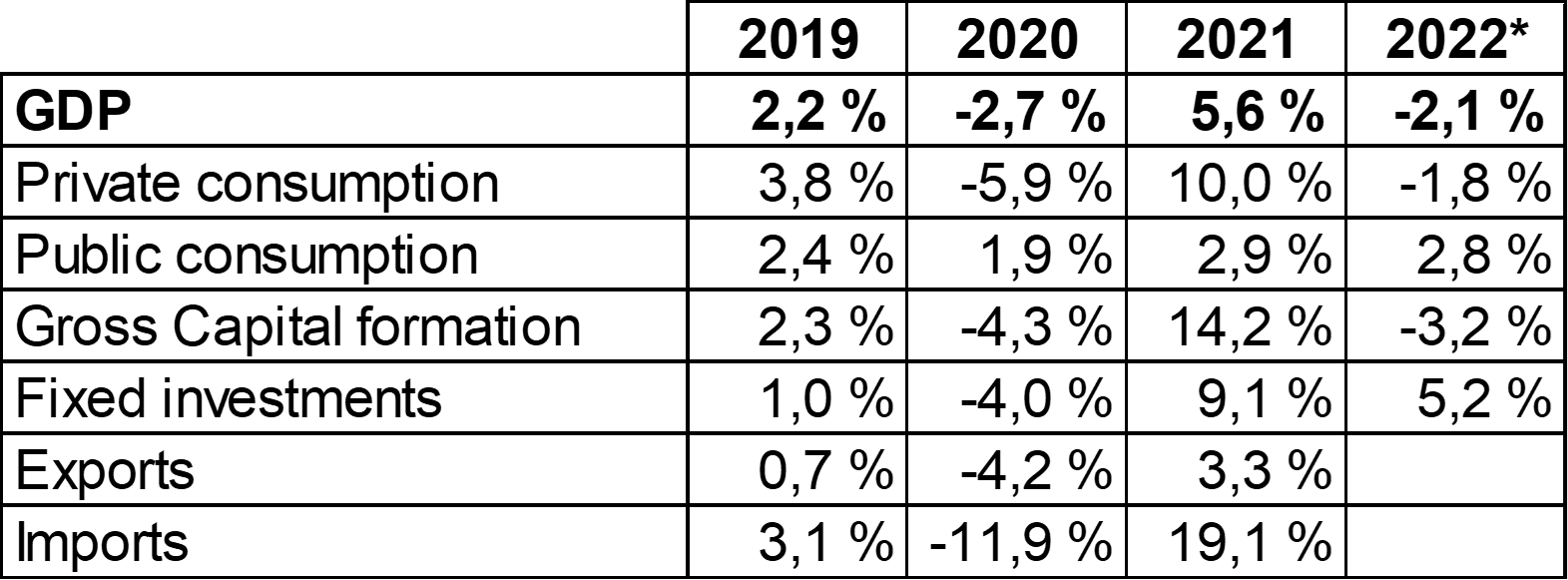

Rosstat last week released its first assessment of Russian GDP in 2022. According to its preliminary estimate, Russian GDP contracted by 2.1 % last year, a better-than-expected performance that surprised nearly everybody monitoring Russia. The economic contraction was slightly less than Russian officials expected (e.g. the Central Bank of Russia estimated just a week earlier that GDP contracted by 2.5 % last year). The CBR predicted last November an economic contraction of 3.3 % for all of 2022, while the Consensus forecast by international investment banks was still - 4.2 %.

The initial on-year estimate of economic performance is typically inconsistent with quarterly data. We thus expect the situation to clarify with the release of fourth-quarter data. Even with that information, Russia’s economic data will still be subject to several subsequent revisions. Currently released data suggest that the Russian economy ceased to contract in early autumn.

In addition to the apparent year-end growth spurt, Rosstat’s initial estimates of GDP by end use are difficult to interpret. Figures on the volume of total exports and imports are not released, and numbers inferred from other components imply about zero net exports last year. That estimate does not comport with available information on the value of foreign trade. Preliminary balance-of-payments figures indicate that the value of total imports contracted by 9 % y-o-y, while the value of total exports grew by 14 %. Using mirror statistics of Russia’s main trading partners, the value of Russian goods imports fell last year by 23 %, while the value of goods exports rose by 23 %.

Looking again to the GDP by end use figures, private consumption contracted last year by 1.8 %, while public consumption rose by 2.8 %. The contraction in private consumption reflects the decline in real incomes (down by 1 % y-o-y). On the other hand, the contraction in retail sales (down by 6.7 %) suggests that the decline should have been more pronounced. We expect some of this confusion to resolve with the release of the 4Q22 figures. Last year’s nominal growth in public spending (over 20 % according to preliminary figures) was exceptionally high. It implies that public spending increased by nearly 10 % in real terms. Federal budget spending was up by 25 % y-o-y. Most of the increased government-sector spending showed up in public consumption and public investment.

Gross capital formation fell by 3.2 % y-o-y. The decline was due almost entirely to a massive drop in inventories. Corporate inventories have been drained by the uncertainties of war, sanctions and disruption in logistics chains. In contrast, fixed capital investment shot up by 5.2 %. The growth in fixed investment is largely due to investment projects with public support launched before 2022 and the government’s own investment projects. For example, the budget funding for national projects increased by 29 % last year. The bulk of the national project spending involves construction of transport infrastructure. In addition, procurements related to the war effort may have been booked as public investments.

The impacts of a year of war in Ukraine were well reflected in the chaotic trends on the production side of GDP calculation. Agricultural value added was up by 8 % y-o-y, boosted by bumper harvests last year. Mining & quarrying (includes oil & gas extraction) showed almost no growth (up by just 0.4 %), while manufacturing output fell by an average of 2.4 %. The fluctuations have been quite large from branch to branch. Branches that rely on domestic demand or support the war effort grew rapidly (e.g. pharmaceuticals were up by 8.5 % and fabrication of metal products up by 6 %). Other industries, however, have been hit hard by sanctions (e.g. wood processing was down by 12.8 % and auto production down by 45 %). The growth in public investment was reflected in the strong growth in construction sector (up by 5 %). Public administration grew by 4 %.

Rosstat GDP estimates, 2019–2022, yoy change

Source: Rosstat. *first estimate

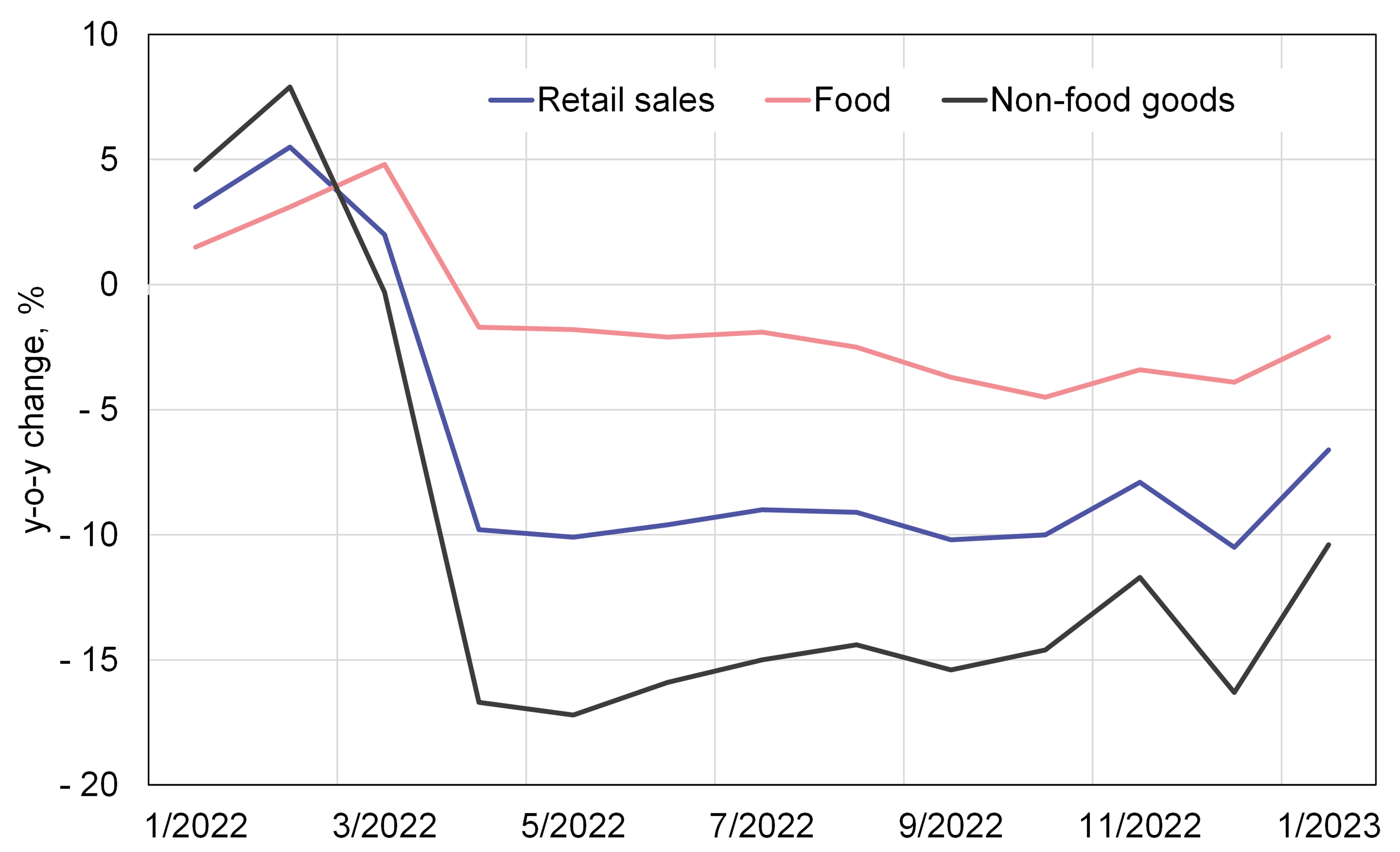

Weak economic performance continued in January

Rosstat’s January figures suggest that no quick turnaround of the Russian economy. While retail sales were only down by 6.6 % y-o-y in January, on-month sales in January were up from December, when retail sales dropped. In contrast, indicators of demand for household services, including hotel & inns, tourism and restaurant & catering services, continued in January to experience the strong growth they enjoyed in the final months of 2022. Manufacturing output contracted by 2 % y-o-y in January, while output of the mining & quarrying sector was down by 3 %. Among the hardest hit branches in the extractive sector were natural gas production (down by 14 %) and LNG production (down by 13 %). Crude oil production was down by just 1 % y-o-y in January.

Federal budget revenues dropped sharply in January from a year earlier, while the pace of spending accelerated (up by nearly 60 % y-o-y). The federal budget deficit in January was already 64 % of the approved budget deficit for all of this year. This suggests that the 2023 budget deficit will be much larger than the 2 % of GDP planned for this year.

The on-year decline in Russian retail sales continued in January

Source: Rosstat.