BOFIT Weekly Review 8/2023

End of zero-covid policies boosts consumer confidence in China

It has been about two months since China abandoned it strict zero-covid suppression policies. Because China releases most of its economic data for January and February as a single package next month, trends can only be implicated from morsels of January data. China combines its monthly data for the first two months of the year to overcome some of the huge variability caused by the Lunar New Year holiday week, which takes place sometime in late January to early February depending on the year. Thus, data on the wider effects of re-opening the Chinese economy after years of lockdowns on retail sales, industrial output, exports and imports, will only become available in March.

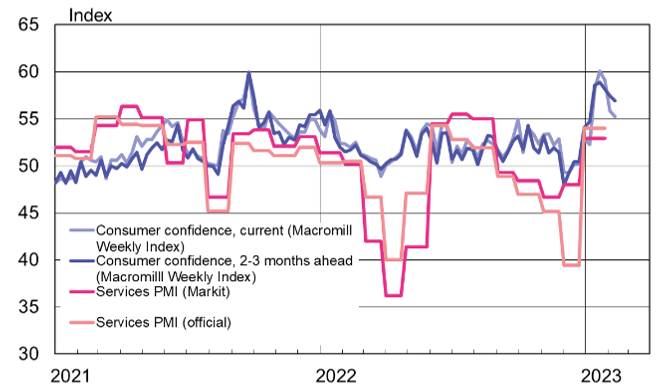

Inklings of rising consumer confidence and a revival in private consumption are already evident. The January readings of the official and Markit services purchasing manager indices were both well above the neutral 50-point mark. The reading for China’s official services PMI was 54.4, and the Markit services PMI reading was 52.9. The improvement in consumer confidence about current and future conditions was obvious by late January, even if no historically sharp rises in confidence were detected. Daily metro ridership in many large cities has already returned to pre-pandemic levels.

Chinese consumer confidence was up in late January

Sources: Macromill, China Federation of Logistics & Purchasing, Markit, Macrobond and BOFIT.

This year’s Lunar New Year fell on January 21. In the week preceding and week after New Year’s Day, China traditionally sees massive internal movement as people travel to their home villages and other cities to see friends and family. After a two-year break, this year’s holiday season saw daily intercity travel climb to around 45 million people. During the previous two pandemic years, daily travel remained well below 30 million. Even so, this year’s travel numbers came nowhere near the pre-pandemic levels of nearly 85 million people a day travelling during and around the holiday week.

Unlike the service sector, readings for manufacturing PMIs in January were close to neutral. The official manufacturing PMI reading was 50.1, while the Markit reading (which gives greater weight to private firms and exporters) remained just under 50 points (49.2). Some of the manufacturing weakness could be attributed to the fall in demand in China’s main export markets after the highs of 2020 and 2021. Demand, especially in the United States and Europe, has shifted from goods to services and high inflation has eroded purchasing power. The volume of China’s exports, which have been contracting since August, was down by 12 % y-o-y in December. While the foreign trade figures for January will only be released in March, there seems to be little change in light of the January figures already released by some of China’s trade partners. For example, the value of South Korea’s imports from China in January was unchanged from a year earlier, while the value of Taiwan’s imports from China were down by 27 % y-o-y.

Consumer price inflation rose from 1.8 % in December to 2.1 % in January. The rise in headline inflation was mostly due to food prices, while also the prices of free-time activities such as tourism and restaurants services were up modestly. Core inflation (does not include food and energy prices) was 1 % in January.

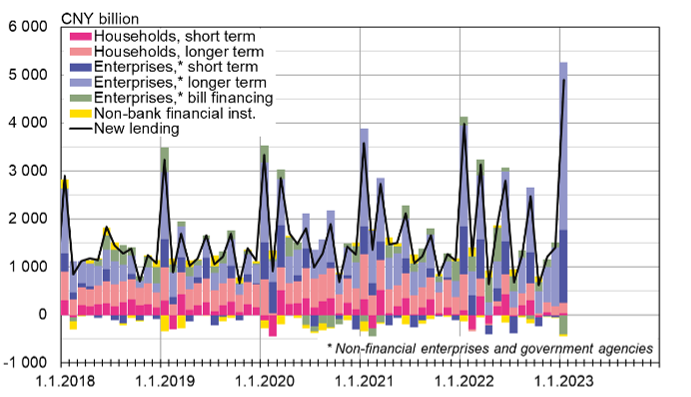

The government has sought to help the struggling real estate sector by encouraging banks to increase their lending and easing loan conditions for both developers and apartment buyers (BOFIT Weekly 6/2023). The volume of new bank loans issued in January rose to about 4.9 trillion yuan, a roughly 25 % increase from January 2022. The lion’s share (over 70 %) of new bank credit issues were long-term corporate loans. There was apparently little change in the amount of new housing loans. Roughly 220 billion yuan in new long-term loans to households were granted in January, which is less than a third of the amount typically granted in January in recent years.

The volume of new loans to enterprises at record-high in January, housing loans remained muted

Sources: People’s Bank of China, CEIC and BOFIT.

INDEBTEDNESS CONTINUES TO CLIMB AND FISCAL DEFICIT REMAINS LARGE

As part of its annual Article IV consultation with China, the IMF released at the beginning of February a comprehensive Country Staff Report on China’s economic policies and economic trends. The IMF assessment mentions the real estate sector’s problems, slack consumer demand and the slowdown in global economic growth as factors driving the increase in private and public sector indebtedness and the deterioration of the balance sheets of especially smaller banks.

According the China’s official statistics, the combined debt of central and local governments last year was just 52 % of GDP. The IMF’s estimate, which doubles that to about 112 % of GDP, includes both official public sector debt and the debt of off-budget local government financial vehicles (LGFVs), as well as state funds. LGFV debt equalled 48 % of GDP last year and is expected to reach 53 % this year. With the downturn in the construction sector, sales of land-use rights have dropped off precipitously, substantially reducing an important revenue stream for local governments. To make up for lost sales, LGFVs have now been told to buy land-use rights, which only increases indebtedness. The IMF expects China’s consolidated public debt to reach 121 % of GDP this year. Only a fifth of that is central government debt.

The IMF expects household indebtedness, which last year corresponded to 61 % of GDP, to remain at roughly the same level this year. Corporate indebtedness, on the other hand, is expected to keep rising. Corporate sector debt (not counting LGFVs) last year equalled 119 % of GDP, and is expected to rise to 123 % this year. The IMF estimates that overall Chinese debt outside the financial sector should rise this year to 306 % of GDP.

The official budget deficit last year corresponded to 9.5 % of GDP, but that does not include off-budget spending. The IMF calculates that the actual public sector budget deficit last year was closer to an eye-watering 17 %. The IMF also sees China maintaining a fairly accommodative monetary stance this year while it gradually phases out covid-era fiscal stimulus programmes. Thus, the actual public sector deficit should begin to shrink gradually, even if does not fall below the 15 % level until 2026.

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.