BOFIT Weekly Review 44/2017

Russian central bank continues accommodating monetary policy

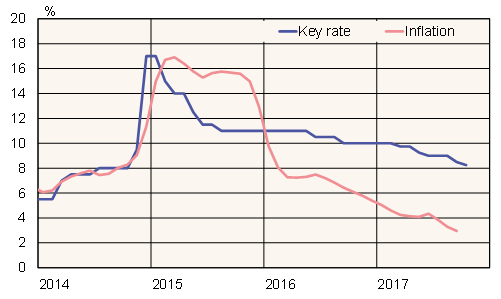

At its regular meeting last week, the Central Bank of Russia's board again lowered the key rate. The 25-basis-point cut to 8.25 % took effect on October 30. The central bank board noted that, while the slowdown in 12-month inflation continued in October with inflation dropping below 3 %, it was due mainly to transient factors. In addition, the CBR said that the fall in inflation expectations is not yet sufficiently large, sustainable and broad-based to justify more robust rate cuts.

The rate cut was in line with market expectations. The latest cut included a slight change in the CBR's forward guidance. Earlier cuts were accompanied with messaging about the need to maintain a moderately tight monetary stance, but now the CBR referred to a gradual shift from the moderately tight stance to neutral monetary policy. In addition, the CBR noted further rate cuts are possible in the next meetings instead of the earlier six-month horizon. Many market analysts viewed the guidance as an indicationg of a faster relaxation in the policy stance, even if specific interpretations vary somewhat.

At the September rate meeting, governor Elvira Nabiullina emphasised that making the current 4 % inflation target sustainable would require a further reduction in inflation expectations and an anchoring of those expectations at a lower level. She noted that the level of key rate in the range of 6.5 -7 % that is compatible with the inflation target might be achieved in 2019.

The pace of Russian inflation has slowed in recent months to record lows – so low in fact that some Russian government officials have called for even more accommodative monetary policy. President Vladimir Putin, however, recently expressed strong support to the CBR's cautious policy approach.

CBR key rate and 12-month inflation

Source: Macrobond.