BOFIT Weekly Review 38/2016

Yuan interest rates spike again in Hong Kong; mainland China money markets remain calm

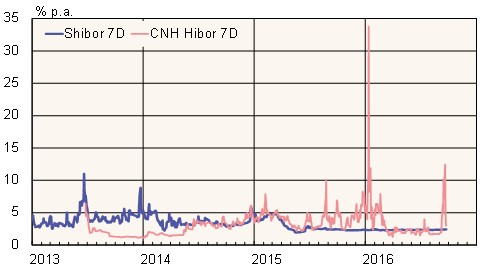

It became again expensive to hold yuan outside mainland China with the second spike this year in the Hong Kong interbank offshore yuan rate. On Monday (Sept. 19), the overnight borrowing rate climbed to 24 %, falling back to 1.5 % on Thursday (Sept. 22). While normal seasonal fluctuations in money demand drove part of the increase, observers speculate that in order to reduce depreciation pressures on the yuan, the People’s Bank of China instructed China’s large state-controlled banks to reduce offshore market liquidity to make it more costly to speculate with weakening of the yuan.

An even more dramatic throttling of liquidity occurred last January, when interest rates on overnight yuan loans soared above 60 %. The PBoC then also sought to reduce offshore liquidity to alleviate depreciation pressures on the yuan and narrow the gap between the onshore (CNY) and offshore (CNH) rates to stave off capital outflows caused by plunging stock markets. Despite efforts of officials to plug certain outflow channels, the outflow of capital from China has continued, albeit at a significantly more moderate pace than in the first half of the year. China’s foreign currency reserves fell in August by $16 billion to $3.19 trillion.

The yuan-dollar exchange rate has remained below 6.70 in both mainland China and Hong Kong market. Since February, the CNY/CNH gap has been almost non-existent. Some market participants expect the yuan to remain fairly steady until October 1 (when the IMF adds the yuan to its SDR basket), and then weaken somewhat for the rest of the year. Depreciation expectations have also driven the drop in demand for yuan in Hong Kong. At end-July, yuan deposits in Hong Kong were only about two-thirds the level of a year ago. Issues of yuan-denominated dim sum bonds have also fallen.

In contrast, mainland China money markets have been stable with interbank rates unchanged at about 2 %. The PBoC has increased market liquidity through open-market operations. Along with overnight and 7-day operations, it is also providing banks with access to long-term financing.

Yuan interest rates on interbank markets in mainland China (Shibor) and Hong Kong (CNH Hibor) (% p.a.)

Source: Macrobond.