BOFIT Weekly Review 1/2016

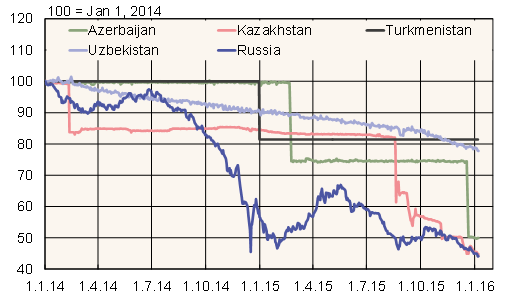

Lower oil prices hurting values of ruble and other CIS currencies

At end-December, ruble hit new lows for the year pulled by declining oil prices. The ruble has renewed its slide in recent days as oil prices have tested lows not seen in over a decade. Yesterday the USD/RUB rate closed at 75 and EUR/RUB rate at 82 rubles.

Low oil prices have socked not just the ruble, but the currencies of other CIS energy-exporting countries. Oil and natural gas (the price of which tends to follow oil price changes with a lag) account for 60–95 % of exports of Azerbaijan, Kazakhstan and Turkmenistan. Natural gas is an important source of export earnings also for Uzbekistan. The currencies of these countries have been long de facto pegged to the US dollar, but in 2014–15 they experienced significant devaluations.

Besides putting pressure on exchange rates, the drop in oil prices severely hurts budget revenues in these countries, creating pressure to cut public spending. Fortunately, most CIS energy-producing countries built up large funds during years of strong oil and gas revenues and still expect positive economic growth (with the exception of Russia) despite slowdowns. With elderly leaders in Kazakhstan and Uzbekistan approaching retirement, the prospect of bumpy power transitions could add to economic uncertainty.

Dollar exchange rates for select CIS currencies, 2014–2015

Source: Macrobond.