BOFIT Weekly Review 27/2015

Chinese stock markets continue to seesaw

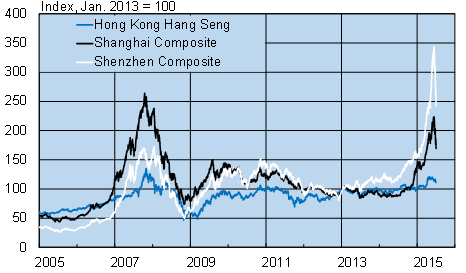

The boisterous rise in mainland China stock markets in the early part of the year gave way to declines last week. Shares prices in Shanghai declined for several days in a row at a pace of about 5 % a day. Shenzhen share prices plunged an average of 6 % a day for several days. Prices of over two-thirds of Shanghai’s listed shares declined 10 % of their value last Friday, the maximum permitted change in price per trading session before trading in such shares is suspended.

Since their mid-June peak, prices of Shanghai-listed shares have dropped over 20 %, while the tech-heavy Shenzhen is down over 25 %. Share prices on the Shanghai exchange on average are still about 25 % higher than at the start of the year, while the average price of Shenzhen-listed shares is still up about 75 % from the start of the year.

China’s extreme stock market volatility is driven by the rush of small investors into the market, rapid growth in margin buying and large swings in market sentiment. Several observers have noted that stock price trends have become delinked from trends in the Chinese economy. Even if private investors hold the lion’s share of mainland-exchange-traded shares, only 7 % of Chinese households hold stocks. As a result, a market correction might not have a particularly large impact on household consumption.

Stock market trends in China

Source: Macrobond