BOFIT Viikkokatsaus / BOFIT Weekly Review 2024/08

The American Chamber of Commerce in China (AmCham) released its annual business climate survey at the start of this month. The survey assesses member sentiment on their prospects in China. Overall, firms reported that their profitability was up from 2022, but firms were also increasingly skittish about new investment. The German Chamber of Commerce in China also released the results of its annual business survey in January. Compared to the Americans, German firms seemed a bit more sanguine about their business prospects, even if nearly half said that the country had lost its allure. German firms also found last year challenging, but were more upbeat about the outlook this year.

The AmCham business climate survey, which generated responses from 343 US firms operating in China, was conducted in October-November 2023. China in the most important or one of the most important investment destinations from half of the responding firms. Still, about half of respondents reported that they had no plans to invest further in China. The surveyed companies considered the course of US-China relations a central issue in their businesses. Roughly 30 % of firms said that they expected bilateral relations to improve this year. Slightly less than a third of firms reported that they had been treated worse than domestic firms in their fields, a slight decline from last year. Unfair treatment was most common in the high-tech and R&D industry. Access to the market remained the biggest reason for unfair treatment. US firms said that the main challenges in China were inflamed bilateral tensions (61 % of firms), unclear legislation and capricious regulatory interpretation and enforcement (30 %), as well as rising labour costs (27 %). These top concerns have remained the same for many years, with the exception new “covid restrictions” entry added to last years’ survey.

566 firms responded to the German Chamber of Commerce survey, which was conducted between September and October 2023. In the latest survey, just over half of respondents (54 %) said that they were planning new investments in China, down from around 70 % reported between 2019 and 2021. Companies involved in car manufacturing (a fifth of respondents) were more upbeat on China (63 % in the car industry said they planned to increase their investments in China). The main reason for increasing investment was to preserve competitiveness in China. German firms viewed legal uncertainty (32 %) as the main regulatory challenge, followed by cyber and data security legislation (25 %) and restrictions on internet access (25 %). Over half of firms reported experiencing discriminatory behaviour in competing for public procurements. Only 44 % of German firms said that the parent company had taken any steps to reduce their China-risk exposure (37 % of firms in the car industry). Firms taking risk-mitigation actions were mainly concerned with geopolitical tensions. The most popular strategies are to build China-independent supply chains serving different markets or additional operations in a third country (China+1 strategy).

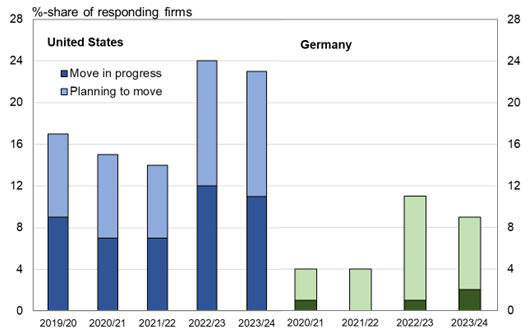

11 % of American firms said that they had already begun to move production or sourcing outside China. Another 12 % said they were considering such moves. The most popular destinations were in developing Asia (including India, Vietnam, Indonesia; 41 % of firms) and the United States (16 %). Last year’s survey still showed shifting production back to the United States as the most preferred option (30 % of respondents). 91 % of German firms have no plans to depart the Chinese market, 7 % were considering cutting back operations, 2 % were going to transfer part of their operations elsewhere and a mere 0.2 % planned to exit the country altogether. The most common reasons given for leaving were poor market prospects (44 %), China’s self-sufficiency efforts (40 %) and increased domestic competition (38 %). For those considering moving operations out of China, the most popular destinations for Germans were also Asia (75 %), but some were also considering moving production back to Europe (39 %). In Asia, the most popular destinations were India (58 %) and Vietnam (38 %).

There has been a slight increase in the number of American and German firms either planning to move their operations out of China or already have such a move underway

Sources: AmCham China & AHK Greater China company surveys and BOFIT.

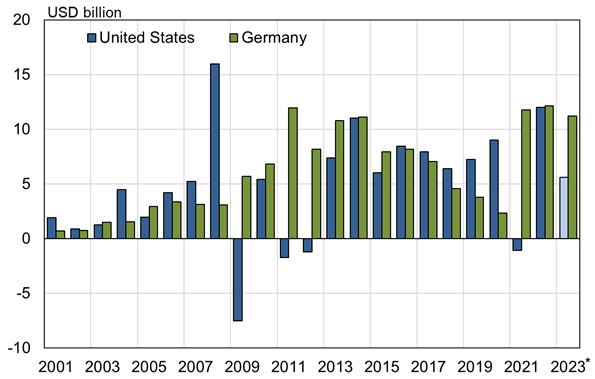

Plans to shift operations away from China or invest less, however, have yet to be reflected in the investment data. More US FDI flowed into China during 2022–2023 than in the immediate pre-pandemic years (2018–2019) or the pre-trade war years (2016–2017). The flow of German FDI into China declined last year by 10 % y-o-y, but was still more than double that of the pre-pandemic years. China accounted last year for 9 % of outward German FDI and 3 % of outward American FDI.

The most recent figures on foreign-owned subsidiaries are for 2021. At that time, 2,230 American-owned firms operated in China. The number of firms rose slightly from 2019–2020, and 5 % of US-owned foreign subsidiaries were based in China. In terms of profitability, last year was the most profitable for US-owned firms in China, even if their total assets were slightly smaller than in 2018–2019. In 2021, US-owned firms employed a total of 1.4 million people (2.1 million in 2015–2018) in China. German firms had 1,800 affiliates in China (6 % of all affiliates of German firms) and employed 512,000 people in 2021. The number of firms and their net sales were up slightly from 2017–2018. In 2021, German-owned firms employed fewer people in China than in earlier years.

German and American FDI flows to China have recovered since the beginning of the Covid-19 pandemic

* US figures for 1-9/2023

Sources: US Bureau of Economic Analysis, Deutsche Bundesbank, CEIC and BOFIT.