BOFIT Viikkokatsaus / BOFIT Weekly Review 2024/05

Russia’s current account surplus shrank last year

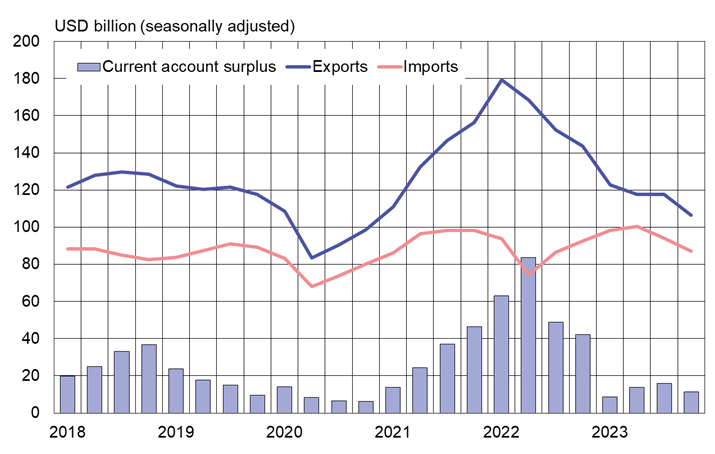

Preliminary figures from the Central Bank of Russia show that Russia’s current account surplus fell last year to around 50 billion dollars. In 2022, the country had a record current account surplus of nearly 240 billion dollars. The size of last year’s current account surplus was not exceptionally diminutive. In 2020, the first year of the Covid-19 pandemic, the current account was smaller (see chart).

The drop in Russia’s current account surplus mainly reflects lower export revenues. The value of goods & services exports contracted by 28 % last year to roughly 460 billion dollars. The value of exports has been declining for many months and continued to contract in the fourth quarter of 2023. The value of goods & services imports increased by 9 % for all of 2023 to around 380 billion dollars. Imports recovered briskly in the first half of 2023, but thereafter declined. The value of imports in the fourth quarter was down by 7 % y-o-y.

The value of Russian exports and imports of goods & services declined in 4Q23

Sources: Macrobond, Central Bank of Russia, BOFIT.

Sanctions reduce Russia’s export earnings

Russian export earnings were mainly eroded last year by falling commodity prices on world markets and Western sanctions on Russian exports. Sanctions proscribe the importing from Russia of major commodities, including coal and gold, for countries participating in the sanctions regime.

Sanctions on Russian oil exports bit deepest. Russian oil imports to major economic blocs such as the EU is now almost completely banned. Both the G7 countries and the EU have a imposed price cap on Russian oil. The price cap mechanism is intended to keep a stable supply of Russian oil available on world markets while reducing Russia’s earnings on oil exports.

The International Energy Agency (IEA) reports that the volume of Russian oil exports last year was unchanged from 2022. Russia crude oil exports last year averaged 4.9 million barrels a day and petroleum products averaged 2.6 million barrels a day. The IEA estimates that the discount on Russian oil last year averaged 18.50 dollars a barrel.

Last autumn’s discount shrank as the average export price for Russian crude exceeded the 60-dollar price cap, raising a discussion about circumvention of the sanctions regime. The United States, in particular, responded by increasing sanction compliance. In recent months, Russian oil has again been selling at large discounts.

The latest assessments from the Center for Research on Energy and Clean Air (CREA) and the Kyiv School of Economics indicate that the bulk of Russian crude oil is transported by ships registered to nations not participating in the price-cap system and thus not obliged to enforce it. The share of ships not subject to the price cap in exported petroleum products circumventing sanctions has also increased, but still represents far less than half of Russia’s petroleum product exports.

Ruble’s exchange rate stabilises, but repatriation requirements for export earnings remain in place

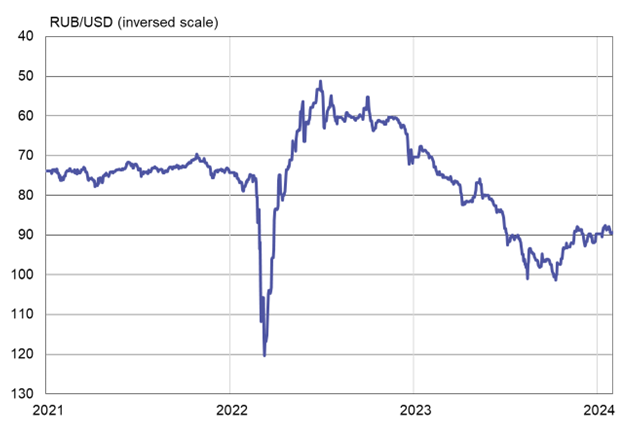

The ruble’s official exchange rate fell by 20 % against the US dollar last year. The weak ruble reflects the shrinking current account surplus and uncertainty caused by war. The ruble’s depreciation episode last autumn continued even with rising oil prices and substantial rate hikes by Russia’s central bank.

The government imposed a forex conversion requirement on large export firms last October to quell ruble depreciation. The policy requires companies to deposit most of their forex export earnings in a Russian bank and convert that currency to rubles. The requirement was initially set to expire at the end of March this year, but will now be kept in place until the end of December. The Russian government says that it wants to see the ruble’s exchange rate stable for a longer period before it lifts the requirement. The ruble’s depreciation episode came to an end late last year. In recent weeks, the ruble-dollar exchange rate has remained stable at around 90 rubles to the dollar.

The RUB/USD rate has settled at a level around 90 rubles to the dollar in recent weeks

Sources: Macrobond, Central Bank of Russia, BOFIT.

Russian GDP growth is expected to slow this year, even as war spending continues to support growth

The International Monetary Fund (IMF) this week released its World Economic Outlook update. The latest WEO now expects Russian GDP to grow by 2.6 % this year. The IMF estimate assumes a dramatic increase in military spending. Private consumption is also expected to increase due to wage hikes in response to Russia’s tight labour market. The IMF expects GDP growth to slow in 2025 to 1.1 %. According to the Consensus Economics average of forecasts of major institutions released in January, Russian GDP should grow by 1.7 % this year and 1.1 % in 2025.