BOFIT Viikkokatsaus / BOFIT Weekly Review 2023/50

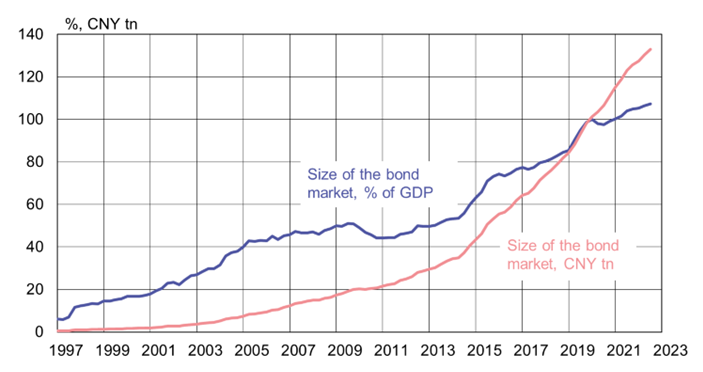

China’s onshore bond markets have continued to experience high growth despite the country’s many economic challenges. AsianBondsOnline, a site run by the Asian Development Bank, reports that the size of China’s yuan-denominated bond market as of mid-2023 hit 133 trillion yuan (18.3 trillion dollars), an amount equal to 107 % of China’s GDP. China’s bond market still grew by 8 % y-o-y, even if the rate of growth has slowed significantly from earlier years. China’s domestic bond market is the world’s second largest after the US bond market.

The public sector is the largest bond issuer in China. The central government, local governments and policy banks together account for about two-thirds of all bond issues in China. Corporate bonds roughly account for the other third. Despite its massive size, potential foreign investors in China’s bond market are put off by China’s capital account restrictions. Chinese commercial banks are the largest bond market investors, owning about tw0-thirds of bonds currently outstanding. In contrast, the bond holdings of foreign investors have declined this year to around 2 %. The share of foreign investors is expected to grow in coming years, however, as Chinese sovereign bonds have been incorporated into major international bond indices in recent years. This should motivate institutional investors to reallocate their investments and increase their Chinese portfolio holdings if they directly track global bond indices.

Although the number of foreign investors participating in China’s bond market has continued to rise steadily thanks to market reforms and eased access for investors, the value of yuan-denominated holdings of foreign investors has shrunk this year. Figures from the People’s Bank of China and the operators of the Bond Connect programme between the bond markets of Hong Kong and mainland China indicate that bond holdings of foreign investors fell by 150 billion yuan (21.2 billion dollars) from the end of 2022 and stood as of October at 3.237 trillion yuan (457 billion dollars). The poor growth outlook for the Chinese economy, the ongoing real estate sector crisis and high interest rates in advanced economies such as the US and the euro area have motivated foreign investors to take their capital elsewhere.

Chinese sovereigns face the risk of a credit-rating downgrade. Although international credit agency Moody’s Investors Service announced on December 5 that it was holding its credit rating for Chinese sovereigns at A1 (the fifth-highest level on Moody’s 21-level ratings scale), it cut China’s rating outlook from stable to negative. Moody’s decision was partly based on an expectation that China’s central administration must ultimately provide financial support to local governments and state-owned firms. Moody’s decision also reflects China’s poor economic outlook and the growing risk from the troubled real estate sector. Even with these red flags, however, demand by Chinese investors for domestic bonds has been sufficient to support the bond market this year as holding bonds is seen as a rational strategy for reducing risk exposure in an uncertain economic environment. As a result, the interest rate on China’s 10-year bond has fallen by about 0.2 percentage points from the start of the year to 2.7 % currently. Our latest BOFIT Discussion Paper provides valuable insights into the changing features of China’s bond market.

China’s onshore bond market continues to grow rapidly

Sources: AsianBondsOnline and BOFIT.